The Startup Coop: The framework for startup investments

Recently I wrote about what we are building with WE.VESTR and how we will tackle the inherent complexity of shareholder management. In…

The Startup Co-op: The framework for startup investments

Recently I wrote about what we are building with WE.VESTR and how we will tackle the inherent complexity of shareholder management. In this article, we’ll look into how we can unlock the free flow of capital within the company’s ecosystem while enabling effortless change of ownership and cross-border investments without the intervention of a notary.

Sounds ambitious but we believe it’s the future. The key to achieving this is in adopting novel frameworks like the Startup Co-op. This model allows for aligning the entire supply chain of a startup, from the very start, and can greatly contribute to the cap table and equity management of a startup. Crossing the valley of death together, but also sharing the upside of the venture.

While we believe the framework would significantly increase the chances of success, we will never impose its adoption on those who use the other functionalities of our platform. It is a part of the integral solution we can offer.

Why is a new framework necessary?

European startups are structured in an inflexible way. Our entities cause permanent disorder in cap tables and make it very complex and expensive to properly reward stakeholders (e.g. employees) at different stages of a company’s lifecycle. For example, the Dutch BV structure is set upon the premise that everyone contributes equally, and, in this way, shares are expected to be distributed evenly. More often than not, this turns out differently, leading to arguments among stakeholders. This inflexibility can seriously impede the necessary growth in the first, turbulent period of a startup.

Bureaucracy

In the past, I’ve also struggled with conventional frameworks. When we started Barqo, we gave two good friends a very favorable slice of the pie in exchange for a relatively small investment. The investment was part of our FFF round (friends, family, fools). Although it was fun and educational for them to be part of this adventure, what both parties didn’t foresee was that there would be a lot of change of ownership over the years in order to let the platform grow rapidly. Next to this, continuous interactions with our notary drove them completely crazy, with piles of paperwork to sign every time a change in the cap table occurred. Looking back now on these times, there were some truly hilarious scenes, but the inertia and frustrations all this caused were far from ideal for our business.

Rarely prepared for a change of ownership

Another learning moment from my earlier days as an entrepreneur, at the same startup, is when we had to split ways with one of the co-founders. Fortunately, the decision came from both sides. However, he still held 20% of the shares.

Inexperienced as we were, we did not have a proper leave construction (or cliff) in place, set from the beginning, that would allow us to only convert the number of shares that would match the effort and time he spent on our company. It was a sticky situation that could have seriously hampered our growth at an early stage. Luckily, we came quickly to an agreement via a SPA (Share Purchase Agreement), but this could have ended very differently.

These are just two experiences I have of many. Try to imagine what others have gone through and the times when things didn’t end so well. (Or share your experiences in the comments).

Cooperatives | The comeback

We’re constantly trying to move with and ahead of time, making sure we embrace positive change and avoid being ‘stuck in the past. But sometimes there’s a good reason to look back and take lessons from history as we are building the future.

I’m talking about a cooperative — an oldie but a goodie. Many large companies in Europe have been set up this way. Companies like Rabobank (€ 12.1 BLN) and Flora Holland (€ 4.7 BLN) are famous examples of it.

The Cooperative is a legal entity type that is very much comparable to the Private Limited Company (B.V). It can have assets, employees, make debts, go bankrupt, and is also subject to the same tax laws, such as VAT, company tax, and dividend tax. However, this entity type gives greater flexibility in the change of ownership, profit-sharing, and voting allocations. It gives the freedom to determine the rules of the game yourself, and the rules can change and evolve as a company does.

A short history lesson

To understand cooperatives even better, let’s go back over 400 years when the Dutch East India Company (VOC) was created. In 1602, with the backing of the Dutch government, the VOC was established by amalgamating six rival trading companies, and it was granted a 20-year monopoly on trade with India and Southeast Asia.

The real ground-breaking genius of the VOC was in its funding. Money could be loaned to the company in exchange for permanent shares and membership. The VOC was the first-ever company to use an initial public offering (IPO) and this allowed it to raise capital for outfitting its first fleet. Voyages were funded through the sale of bonds, leading to the VOC becoming the world’s first publicly listed company on the Amsterdam Stock Exchange (also the world’s first stock exchange). And from 1606, VOC shares could be publicly traded.

The VOC’s simple idea for investments in exchange for shared ownership and management of a company grew into the model that we know as the cooperative. We consider it to be the European equivalent of the Delaware LLC. 90% of the US startups currently use this entity type because of its flexibility due to the common law system of the Anglo-Saxon countries.

Introducing the Startup Co-op

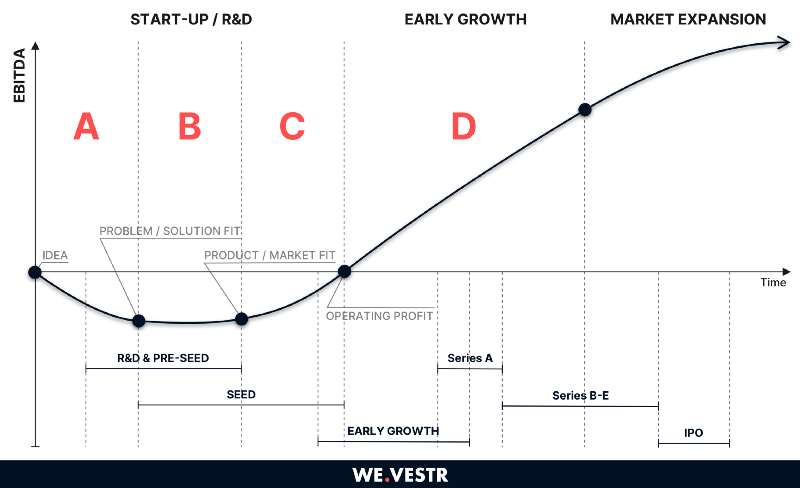

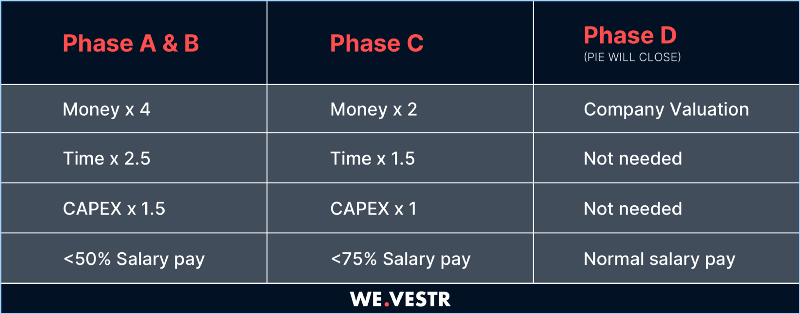

As you can guess, the Startup Co-op is based on a cooperative legal framework. And the beauty of it is that it allows us to apply the SlicingPie model — an existing cut-to-size model (currently being used by 12k+ companies) that rewards time, cash, IP, and CAPEX with self-determined multiples depending on the stage the company is in.

At WE.VESTR, we’re digitizing this setup and making it fit for the needs of the new-age entrepreneur :).

Using our framework offers some undeniable advantages:

- New investors can be brought into the cap-table easily without the use of a notary. The cooperative framework offers flexibility in profit-sharing and vote allocation. The (digitized) startup co-op allows keeping a fully digital shareholder register — crucial for regulatory compliance including KYC/AML.

- The framework provides an easy way for the internal exchange of shares — this could possibly be extended to external exchange platforms.

- Ownership can be easily shared with employees or other stakeholders. Sweat equity is easy to reward. Give someone a bunch of euros, and they will help you for a day. Give them ownership, and they will be on your side for a lifetime.

- A flexible entity where you determine the rules of the game yourself. Set up deals in a flexible way and issue all kinds of shares that fit the situation or phase.

If needed, a framework can always be turned into a regular BV (Private Limited Company) or NV (Public Limited Company) when the turmoil has ended.

With the popularity of cooperatives across all European countries, articles of association are almost identical from one jurisdiction to the next. We can simply take advantage of local law already in place to create near-parallel legal frameworks in each country and create a single digital market. This way, we can cooperate with established markets in the US (Similar Delaware LLC) and emerging ones in Asia, all whilst keeping talent and technology firmly rooted here in Europe!

Thanks for reading :). Send me PM or reach out to me at [email protected], if you want to learn more about what we are building and would like to see a demo. Happy to answer any questions and feedback is more than welcome!