Startup Spotlight: Wonderful

An interview with Kieron James, the founder of tech-for-good group, Wonderful.

We first met Kieron in the halls of Rise London, the home of our WE.VESTR office in the UK. When we heard his wonderful story, we knew that Wonderful would make for a perfect Startup Spotlight.

The story of Wonderful is one of problem-solution fit that warms the heart, and it's a great example of monetizing an impact startup without selling the soul of the company.

Enjoy!

A Wonderful Story

Wonderful started back in 2016 to address a rather troubling problem in the charity sector.

The Problem: Donations raised in the vast majority of UK fundraising campaigns were not being passed to charities in full. Instead, a large chunk was lost to fundraising platforms’ administration charges, monthly subscription fees, and card processing costs.

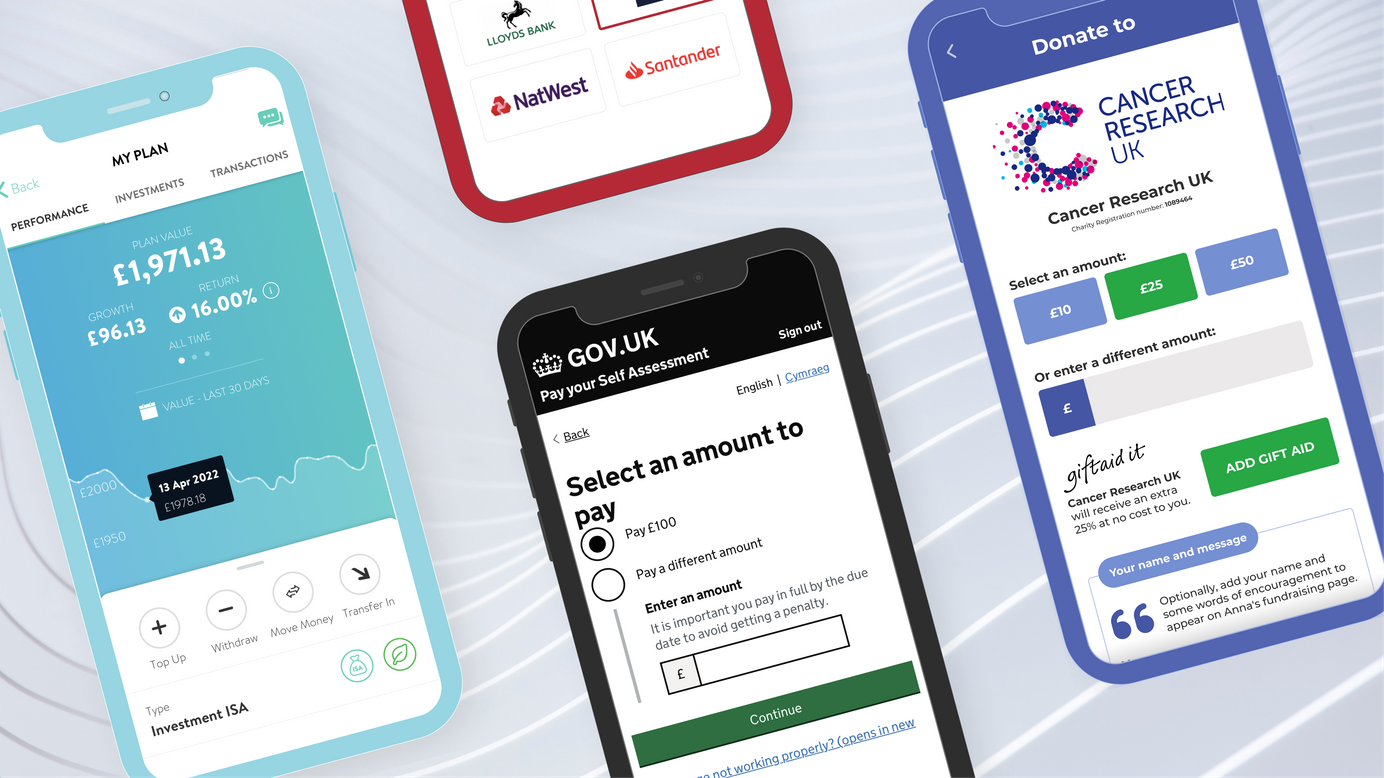

So, Wonderful.org was launched as a totally fee-free alternative for charity donations and fundraising; with all costs covered by then-corporate sponsor. However, the more fundraising that happened through Wonderful.org, the more card payments had to be processed – a greater burden to their corporate sponsors.

That's when Kieron and team launched Wonderful Payments, a payments-as-a-service company for corporate transactions. But rather than calculating a fee based on the value of each transaction, Wonderful Payments simply charges a fixed amount per transaction or a pay-per-month rate (based on volume).

And like all wonderful things, the revenue they generate from Wonderful Payments sponsors the work they do at Wonderful.org, enabling them to continue delivering totally fee-free processing of charity donations and fundraising.

We love it when a plans comes together.

Check out our interview with Kieron James, below.

Tell us a bit about the origin of Wonderful Payments.

Since the inception of Wonderful.org, we’ve weathered doubts and nay-saying. Many thought a fee-free giving platform was unfathomable, but we created corporate sponsorship models that made it a reality. As we grew, our success paradox felt insurmountable, card processing costs swallowing up our entire sponsorship budget.

So we mobilized open banking to eliminate cards from the process altogether, shrinking costs to a fraction of what they’d been.

And now, there are those who are dubious about the speed of adoption we should expect from open banking. Others who think that, like music streaming, it’s just a flash in the pan. But, by harnessing the revolutionary potential of open banking, Wonderful makes online checkout simpler, safer and more affordable, bringing a new approach to a tried and tested process.

Meanwhile, revenue from our commercial clients will allow us to maximise charities’ impact. It’s FinTech firmly rooted in doing good.

Moving from one service to another sounds tricky. How did you manage and prepare your company stakeholders for the transition? i.e. staff, advisors, investors, etc.

There was always a passion for the online giving platform - amongst shareholders of the commercial telecoms business who allowed our team to develop the original platform during coffee breaks - and agreed to support the first million pounds raised through it.

Similarly, suppliers have given in-kind (legals, application hosting, and much more). So, breaking the news that we were about to offer all the staff a position in a new payments business was not only not a surprise, but was warmly welcomed. This would allow us to extend the reach of the platform and launch a tech-for-good company.

Making charity donations easier and more economical is something most people can get behind. But there were surely challenges in developing a viable business model around it without scaring folks away. What are the nuances of commercializing impact-driven companies?

Wonderful.org has - and always will be - completely free for charities to use. It’s a point on which we will never negotiate. When we created the online giving site, we recognized the wonderful work of charities, donors and fundraisers and believed a fundraising platform could be wonderful too! Not for profit, no charges whatsoever and operated by volunteers.

We still had suppliers to pay and our biggest bill (by far) was payment processing. This was picked up by our corporate sponsors but did cause a genuine pain point as we scaled.

Replacing cards with open banking was an epiphany. We instantly saw that the problem we were solving for charities extended way beyond the third sector. We see no tension in extending the payment processing service to the commercial sector. It allows us to introduce new, free services for charities AND extend our virtuous circle of charities, donors and fundraisers to include retailers and consumers too.

Or as we like to say - you don’t have to run the marathon, you can be wonderful just by buying (or selling) the trainers.

Follow the Wonderful Payments story at https://wonderful.co.uk

Follow the Wonderful.org story at https://wonderful.org/