Startup Spotlight: Predictive Black

Enjoy our interview with Zitah below, where she tells us how she and her team discovered the problem-solution fit for Predictive Black, and why knowledge is power for startups and SMEs when it comes to cash forecasting. 💡

The moment we learned about Predictive Black and their mission to deliver data-driven financial reporting as a way to empower founders – let's just say we felt like kindred spirits.

We first met Zitah McMillan after being connected through Microsoft for Startups in London. Once we got to chatting about the power of reporting in growing businesses, we knew that she and her team would make for a great Startup Spotlight.

Enjoy our interview with Zitah below, where she tells us how she and her team discovered the problem-solution fit for Predictive Black, and why knowledge is power for startups and SMEs when it comes to cash forecasting. 💡

💭 How did you discover the problem that Predictive Black solves?

Immediately before founding Predictive Black, myself and my co-founder, Mike Valadakis, worked together running a group of consumer lending businesses across Europe for an American parent company.

On a monthly basis, although it felt more like daily, we had to report our cash position for the region and the individual companies to our central team in the United States. A multi-market, multi-currency, multi-organization, and multi-product line Excel spreadsheet was the answer. Except it clearly was the wrong answer.

My team, and Mike at the helm as CFO, spent pointless hours trying to tie the numbers back to something that made sense, then get that over the US team for them to put together with the other regions and figure out the overall cash position of the company.

You guessed it, by the time they had a number to share it was out of date and probably the whole process had started again for the next month. It was time-consuming, inaccurate, and subject to human error at ever interaction.

When the time came, after we had led the sale of that business, Mike and I decided there had to be a better solution. There are tons of treasury management solutions out there for large firms who can afford the big-ticket price, but we wanted to create something that smaller enterprises could use, be they startups or SMEs.

💭 Why cash forecasting? Who was doing it, and why is Predictive Black unique?

It’s a cliché but doesn’t make it any less true: cash is the lifeblood of a company.

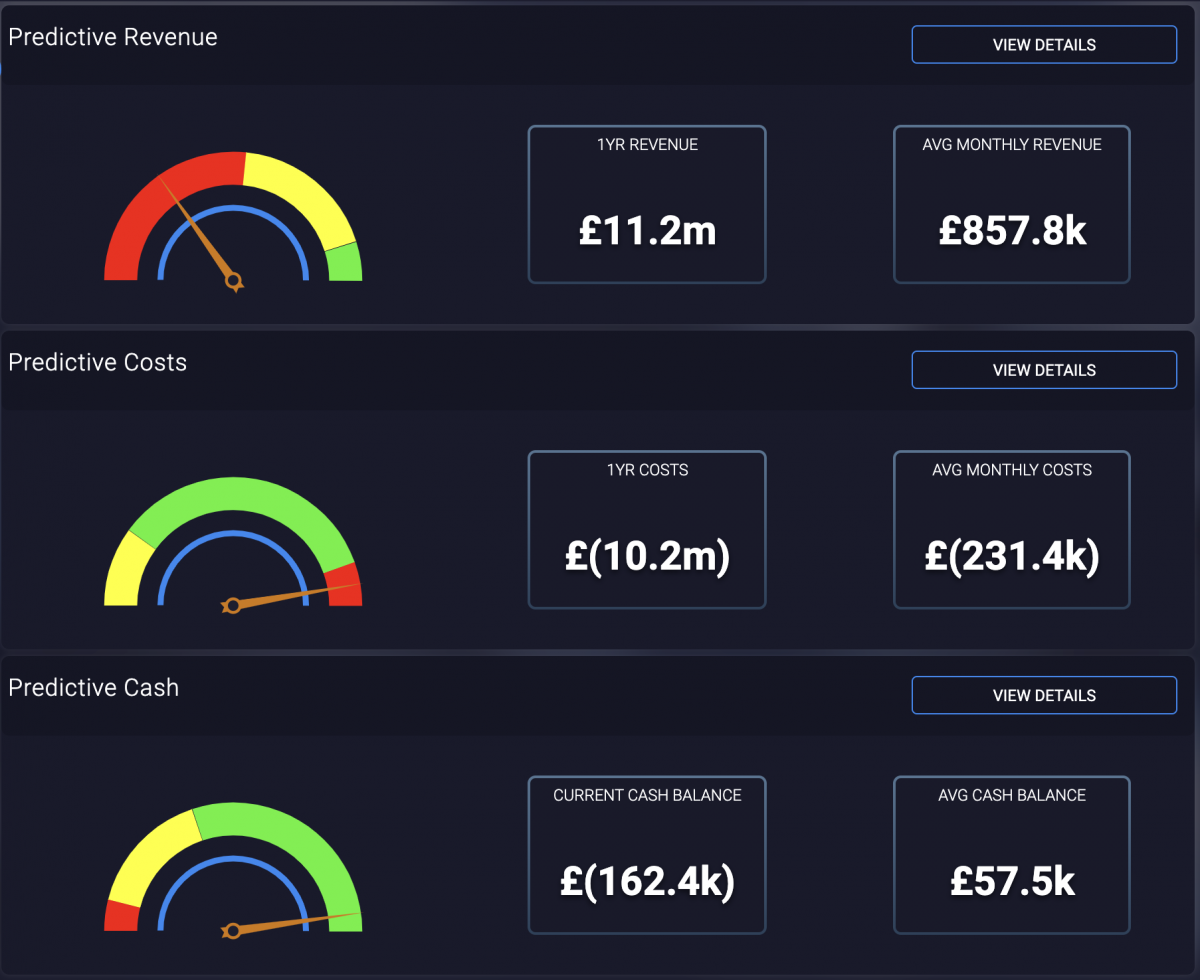

You can have the best idea in the world and even have some great revenue coming in. But, if your cash position isn’t stable or your future runway looks uncertain, your company won’t survive.

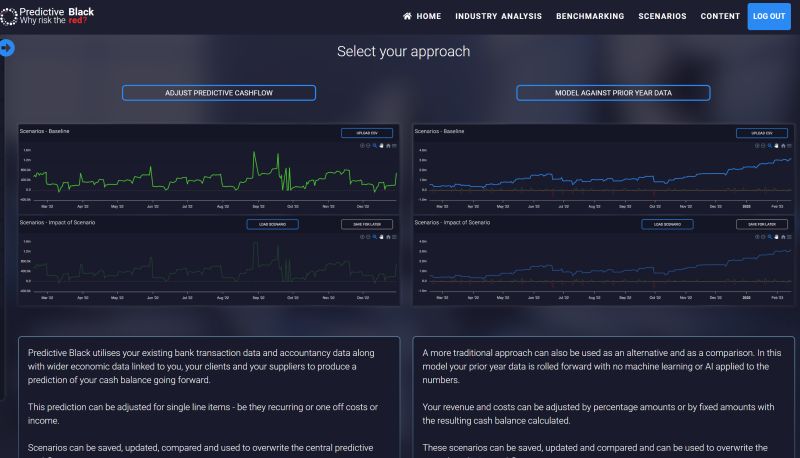

There are a lot of basic cash forecasting tools on the market, but they’re mostly not much better than your old Excel spreadsheet. How we differ is that we take a client’s financial data, either via open banking or open accounting API, and then take the relevant sector data to produce a forecast that’s rooted in the reality of their sector.

It’s not a best guess, + or - % on previous years' results. It’s continuously looking at the input data and adjusting based on our machine learning process.

💭 How do you think startups can benefit from using Predictive Black?

Startups get asked the same questions about their financial position whenever they’re raising money, “What’s your revenue forecast, what’s your runway, what will you spend the investment money on and when will we see a return?”

They may also be asked, “How’s your sector performing, what share of that market can you address, how are your doing versus other companies in your sector right now?”

Some startups may have their answers memorized, but imagine being able to show with more certainty and less effort. What would that look like?

Using our platform will help startups get their thinking straight on the numbers at the outset. We have pre-built scenarios that can be populated with their data to show how investment will be spent and how the forecast will change. We have all of the sector data they’ll ever need, all in the platform, updated as new data is published. This data can be used not only to show how they’re performing but also when they’re looking at sectors to target for new business.

Plus, once their financial data is connected, they can see in real-time what their revenue, cash, and cost performance look like. No spreadsheets required. Just accurate numbers.

💭 How did you compose your team, and what's everyone's expertise?

We teamed up with two other people as our co-founders at the start of process; one had deep technical knowledge to build the platform and the other had the data analytics/machine learning experience.

Mike and I were the clients in the room, the sales people, the marketing team, and the 'test-stuff-until-it-breaks' people. Since then, we have built out our technical and data teams and outsource whatever else we need on a short term basis, as and when we need it. This approach keeps us focused and means we’re not carrying a lot of unnecessary overhead.

💭 Who is your typical customer these days? Is it who you expected?

Typically we attract customers that are growing and have a few things in common:

- They’ve outgrown the cheap and cheerful forecast available in their accounting software.

- They know a spreadsheet carries far too much risk and takes too long to keep accurate and up-to-date.

- They want to reduce time-wasted on something basic yet fundamental like their cash forecast.

We’ve also seen quite a lot of interest from specialist business lenders who want to know more about their current and potential clients. Accessing bank data on a regular basis is far better than a one time or annual review of the annual accounts -- which are generally out-of-date before you’re got around to looking at them.

Follow along with Predictive Black on their website and on Linkedin.