6 things to consider when choosing shareholder management software

Picking the right shareholder management solution is a critical decision for any business. The solution you choose will have a direct impact on the efficiency and effectiveness of your operations. To help you make the best possible choice and save time and money managing your shareholders, we've compiled a list of key considerations.

Below we have listed 6 points you should consider when looking for shareholder management software:

1. Ease of use

If you're like most people, the word "software" strikes fear into your heart. You think of long hours spent hunched over a keyboard, struggling to make sense of coding language. But don't despair! WE.VESTR's software is designed with the user in mind. Our easy-to-use platform will save you time and headaches, so you can focus on what's really important: running your business. With our platform, you'll be able to quickly and easily manage your shareholders, monitor their activity, issue share certificates, and ensure that your company is compliant with all regulations.

2. Compatibility

One question we often get is whether our platform is compatible with other tools/sheets. No one wants their company to go through a major disruption just to switch to a new system. That's why it's important to pick shareholder management software that is compatible with your company's existing systems. This will help to ensure a smooth transition and minimize disruptions. Of course, you also want to make sure that the software is easy to use and has all the features you need. But compatibility is an important consideration that should not be overlooked.

At WE.VESTR, we focus on making the onboarding as easy as possible. With our drag & drop tool, your information is easily integrated into our platform and ready for use. Curious about how this works? Book a demo here!

3. Cost & Features

When you are researching several software solutions, you always are keen to know if you are getting a bang for your buck. The last thing you want is to pay for a SAAS subscription that you will not use.

Software providers offer a variety of features and plans at different price points. It's important to carefully consider the features and costs of a shareholder management platform before signing up. Otherwise, you may end up paying for features you don't need or find that the service doesn't meet your needs.

In addition, some platforms charge based on the number of users, so it's important to know how many people will be using the service. By taking the time to compare features and costs, you can ensure that you choose the right service that will save you time and money.

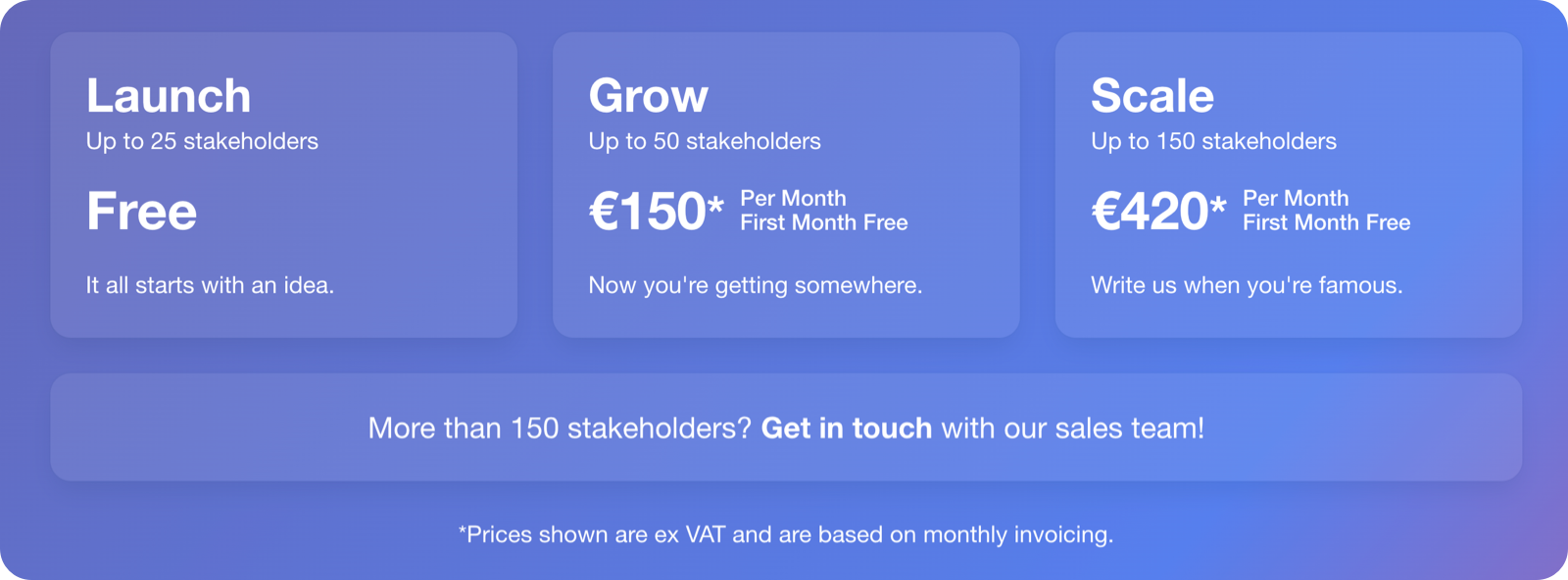

At WE.VESTR, we offer a free plan for up to 25 users/stakeholders. As your company grows, your plan scales along. All plans include the following features:

- Cap Table Set Up

- 2FA Authentication

- Loans & Convertibles

- Shareholder Management

- Data Import

- ESOP Management

- Scenario Modelling

Interested? Start your free plan here!

4. Customer support

Good customer support is essential for any business, but it's especially important in the world of equity management. With so many fixed deadlines, you can't afford to wait for answers when you have a problem.

In most cases, you need to speak to a knowledgeable person right away. The challenge is that many brokerage houses outsource their software support to third-party companies with poorly trained staff. Others offshore the process, prioritizing cost savings over customer satisfaction.

When you're trying to resolve an issue, you want to be able to speak to someone who knows what they're doing and can help you find a solution quickly. That's why it's worth paying a little extra for an equity administration software platform that comes with excellent customer support. It will save you time and frustration in the long run.

5. Scalability of the management system

As your company grows and scales, you'll want a shareholder management system that can grow with you. Small-scale solutions may not be able to handle higher volumes, new features, and integrations as you scale. This can create significant challenges and complexity at precisely the wrong time.

As your company grows quickly, new employees are coming on board, others may be leaving, and fresh rounds of investment are coming in. These factors introduce complexity at a time when company resources are already stretched to their limits. The last thing you want is for your software to be a source of frustration and confusion during this critical period of growth. Look for a solution that is purpose-built for high-growth companies and can scale with you as you grow. This will save you time, money, and headaches down the road.

6. Advisors

Shareholder management software is a critical tool for any growing company. As your organization brings on new hires and issues equity compensation, the process can quickly become complex and time-consuming.

The right software will help you automate and streamline your shareholder management processes, saving time and increasing accuracy. But if it’s not paired with a knowledgeable team of experts who will be there for you as you grow, then you’re only getting half the picture.

A team of experts can help you to navigate the complexities of equity compensation, ensuring that you are in compliance with all applicable laws and regulations. They can also provide guidance on best practices for structuring equity compensation programs and help you to develop custom solutions that meet the unique needs of your organization. When paired with the right software, a team of experts can provide a comprehensive solution for managing equity compensation.

As you consider your options, find out about each vendor’s equity administration services. Will they be there to offer you the flexibility of outsourcing some elements of the process, or even to insource those functions at a later date? The last thing you want is to be stuck with a vendor who doesn’t have the ability to adapt to your changing needs.

Conclusion

The right shareholder management software can make a big difference for any company, but it's especially important for high-growth businesses. Scalability, ease of use, cost & features, compatibility, customer support, and advisors are key considerations when choosing a platform. With the right solution in place, you'll be able to streamline your equity management processes, saving time and increasing accuracy.

At WE.VESTR, we give people the opportunity to have a spin on our platform. You can use it for free for up to 3 users! If you want to learn more, don't hesitate to reach out to us or book a demo. We hope to hear from you soon!