How to Create Your First Cap Table

Starting a startup involves many financial concerns. One crucial one is creating your first cap table. A cap table is foundational. It lays out your company's ownership structure and serves as a roadmap for all future equity decisions.

In this step-by-step guide, we'll walk you through the process of creating your first cap table in a simple and straightforward way.

What’s a Cap Table?

A capitalisation table, often referred to as a "cap table," serves as the blueprint for a company's ownership structure. It provides a snapshot of the distribution of equity and shareholdings among shareholders, investors, and other stakeholders.

For founders, building a comprehensive and accurate cap table is essential. It lays the groundwork for decision-making and is a foundational step in navigating the complexities of equity management.

Step 1: Lay the Groundwork

Starting from scratch with a simple spreadsheet is one way to start creating your first cap table. A spreadsheet can serve as your cap table template, and help form the basis for tracking and managing equity distribution within your startup. However, as your startup grows and additional factors come into play, your cap table can become challenging to manage in a spreadsheet.

Another way is to use a cap table management platform like WE.VESTR, which you can already start using for free and will have additional features designed to help you beyond cap table management, in employee stock ownership plans and future fundraising for example.

Step 2: Structure Your Cap Table

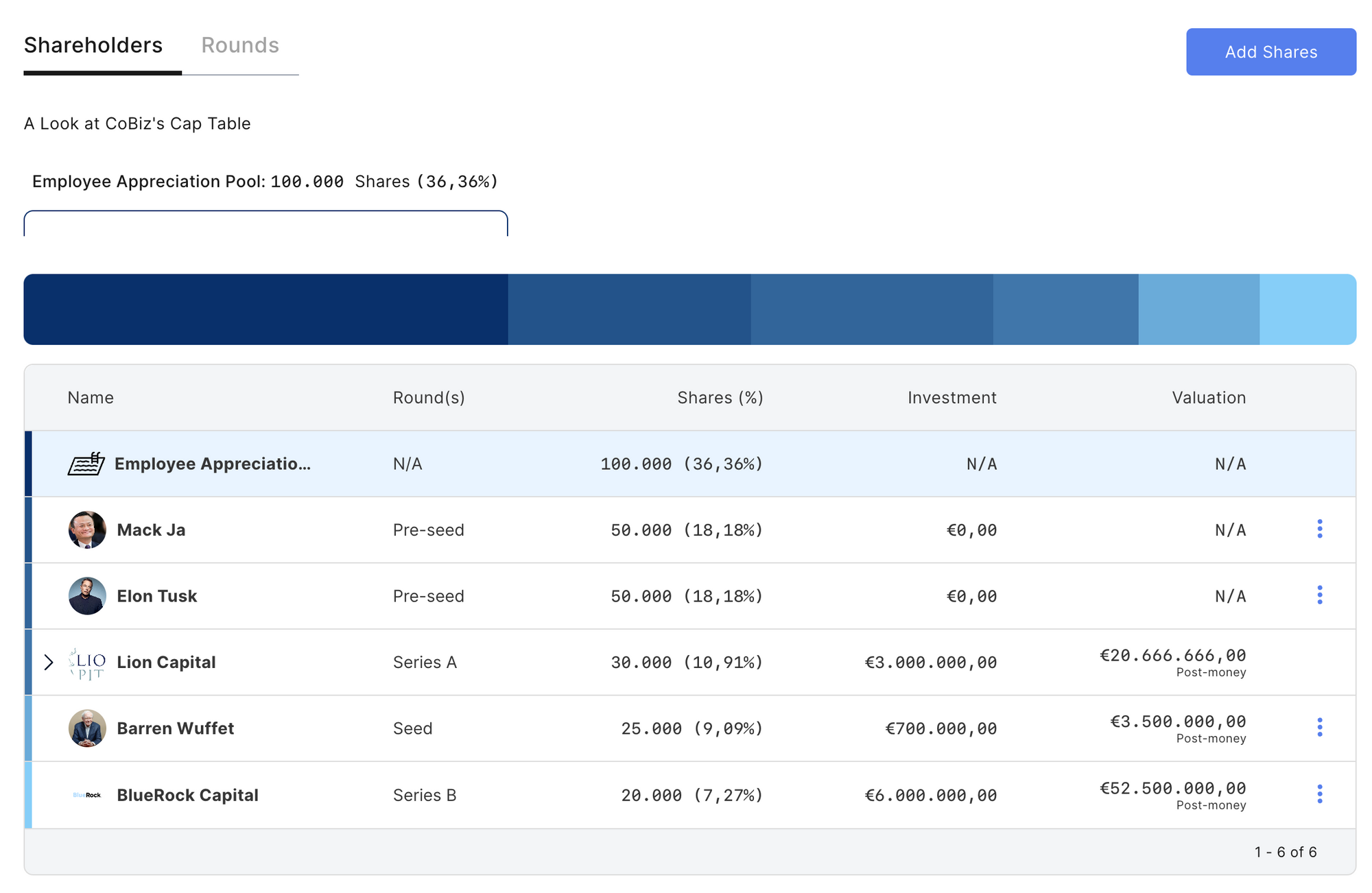

It’s important to keep your cap table structure simple and well-organised. Start by listing the names of your investors and equity owners, along with the shares they own, share price, dates they acquired them, and more. When you input your data, make sure to be accurate. See an example below:

Step 3: Include Essential Components

As you build your cap table, make sure to include key components such as:

- Authorized shares

- Round

- Valuation

- Outstanding shares

- Unissued shares

- Shares reserved for your stock option plan

These will give you a full view of your company's equity distribution, which is vital for monitoring and making smart choices.

Step 4: Anticipate Expansion and Complexity

As your company grows, so too will the complexity of your cap table. Be prepared to expand your cap table to accommodate additional investment rounds, employees, and stakeholders. Consider including supplemental materials such as:

- Lists of shareholders

- Vesting schedules

- Tables detailing investor contributions

This will ensure accuracy and transparency in your cap table.

Ready to streamline your equity management process? Feel free to connect with us if you want to find out more!