Fundraising as a Founder: Convertible Notes & SAFE Notes

Fundraising as a Founder

Fundraising as a Founder

When the team at WE.VESTR asked me to weigh-in on convertible notes and SAFE notes, I immediately began to reminisce about my days as a fundraising founder. Prior to joining the WE.VESTR team, I founded three companies, each with its own fundraising story.

Since late 2008 I have raised investments through FFF-rounds (or Family, Friends and Fans — instead of Fools — as I like to call it), angel rounds, crowdfunding campaigns, sweat equity, and through convertible notes. Each company had its own fundraising needs, and each growth stage of a company comes with a logical preference for the type of fundraising in my experience.

For example, my company CityShare was a social travel network and relied on avid users becoming true fans of the app, and to then invite their network to join the app. In this case, a crowdfunding campaign contributed to the growth of a B2C concept like CityShare because a large set of investors ultimately became fans.

Additionally, sweat equity can be a great option when the involvement of a company — such as physical labor, mental effort, and time — is preferred over money alone. Back in 2015, I wanted to quickly build the MVP for my company Flamyngo. So, when a partner digital agency put together a team of developers and designers who contributed to an accelerated MVP roadmap of just 6 months, they ended up joining Flamyngo’s cap table through sweat equity. This was a perfect setup for a quick launch in a time where it was increasingly difficult to raise investments pre-MVP for a B2C startup.

With all of the different forms of investments on the table, today I’d like to dive into two particularly popular options — convertible notes and SAFE notes.

I’ve seen both find their sweet spot in startup investment rounds over the past decade. Given their popularity, I wanted to spend some time in this article to share my thoughts on when convertible notes and SAFE notes are beneficial for startups, and when founders should find a better fundraising option.

Convertible Notes vs. SAFE Notes

Since European companies began using convertible notes as a fundraising tool, a variety of advantages and disadvantages have been made clear.

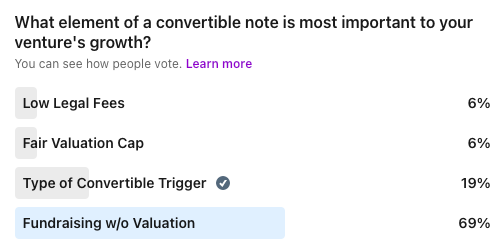

Generally speaking, startups tend to benefit from convertible notes because a formal valuation is not needed to secure the loan. A recent poll that we hosted on LinkedIn supported this as the most attractive component of convertible notes for founders.

Also, convertible notes do not require a shareholder agreement nor the issuance of shares, saving founders a lot of time and money on legal work and notaries.

SAFE notes (Simple Agreements for Future Equity) are similar to convertible notes but are not classified as debt instruments, meaning they don’t have maturity dates nor interest rates. With a SAFE note, founders can gain similar benefits as they could with a convertible note, without the hassle and pressure of taking out formal debt. Created by Y Combinator in 2013, a well-known tech accelerator in the U.S., SAFE notes entitle investors to shares, typically preferred stock. SAFE note investors receive equity in the case of a future valuation event — such as the company closing an investment round given a formal valuation, the company being acquired, or the company IPOs.

Founders love SAFE notes, especially in the United States where Y Combinator has used SAFE notes to fund more than 1,000 startups, including Dropbox, Reddit, Airbnb, Instacart and more. Their popularity is most likely due to the fact that they are not a form of debt and they are a quick method for fundraising.

Are Convertible Notes & SAFE Notes Right for Your Company?

Well, that depends…

…How aligned are you with your current shareholders? Do you feel aligned on the potential value of the company? Are you consistently reporting to them, or are you scrambling to prepare for shareholder meetings?

With convertible notes and sometimes with SAFE notes, founders and investors must negotiate a valuation cap to trigger the conversion of shares. In my opinion, this can create a bad dynamic between investors and founders, as the two parties are pushing in different directions — investors aiming for a low valuation, founders for a high valuation.

Therefore, my advice to founders is to ensure you’re aligned with your shareholders before pursuing a convertible or SAFE note. If you have consistent reporting and all current shareholders are on the same page, then you’re more likely to have their support in negotiations with new investors around a valuation cap of a future convertible or SAFE note. If that doesn’t seem likely, then I would advise either to pursue a SAFE note that doesn’t require a valuation cap (i.e. only states a discount), or to find another method of fundraising.

Also, how is your cap table looking these days? Pristine and organized, or saved in multiple Google Sheets and Excel files?

While many founders enjoy the simplicity and the speed of fundraising that convertible notes and SAFE notes allow, some founders run into issues when it comes to their cap tables. That is, both convertible notes and SAFE notes can lead to ambiguity in the cap table between the issuance of the loan and the convertible trigger moment. This can cause frustration in ownership groups and confusion amongst shareholders.

How WE.VESTR Can Help

As noted above, in order to properly assess fundraising options like convertible notes and SAFE notes, founders must first ensure they have alignment with their shareholders and make sure that their cap table is in order. As the CCO of WE.VESTR, I hope you’ll consider our platform to help with these things.

WE.VESTR unifies your cap table and shareholder reporting with a full overview of your current loans and convertibles. Founders can enjoy the simple fundraising of convertible notes and can avoid any ambiguity or stress with their equity and shareholder management.

Founders are using WE.VESTR to manage their loans and convertibles, including interest rates, payment terms, pre or post money valuation, convertible triggers, total company debt and average monthly repayments — and integrating all of these details with their cap table. Additionally, founders can invite their shareholders to view real-time updates to the cap table, financials, loans, convertibles and more.

Thanks for reading! If you want to learn more about WE.VESTR and how it’s improving the lives of entrepreneurs, you can visit wevestr.com or contact me directly via the LinkedIn. If you’d like to offer your opinion, I’d love to hear from you in the comments.

Cheers,

Maarten

CCO, WE.VESTR